Module: Human Resources Applet: Labor Distribution |

|

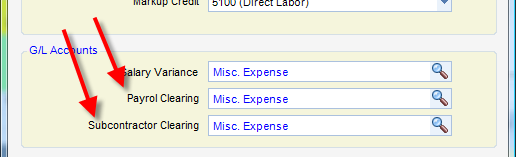

Description - The offset of the direct and indirect postings are divided amount clearing and variance accounts.

There are two clearing accounts: Payroll and Sub-contractor. (Fig.1)

| • | Payroll is the offset for employee time. The payroll clearing account represent the gross payroll burden. |

| • | Sub-contractor is the offset for sub-contractor time. Subcontractors are offset to their own clearing account since they are not part of payroll. |

Fig.1

These accounts are called clearing account because they are assumed to be zeroed-out by another entry (i.e. moving money out of the bank and against the clearing account and various payroll deduction accounts.

The Salary Variance (seen in Fig.1) account deals with the variance between a salaried persons average pay rate and what that person actually gets paid. There are two methods for determining variance. These methods are located in the employee pay history table:

| • | The Standard Day Method - The standard day method allows for change of pay type (hourly or salaried) or salary amount within a pay period. The standard day is based on the average pay rate so the clearing account may not zero out due to rounding. The standard day method can also be used to split time between G/L periods when a payroll transcends two periods. This of course only makes sense in weekly and biweekly payroll and requires running the utility twice. |

| • | The Salary Amounts Method - The salary amount method uses the salary amount and pay type at the start of the pay period only. |

Note 1 - When running a semi-monthly or monthly posting, use the Salary Amount Method. When running weekly or biweekly, use either the Salary Amount Method or Standard Day Method.

Note 2 - The standard day method works as follows. The difference between non-premium time and the standard day is applied to the variance at the average pay rate for week days. The formula is (standard hours-hours worked) x pay rate. For weekends all non-premium time reduces the variance by using the formula (0-hours worked) x pay rate. All days with no time entries use the formula standard hours X pay rate.

An employee must have at least one timesheet line item within the work date range to be processed.