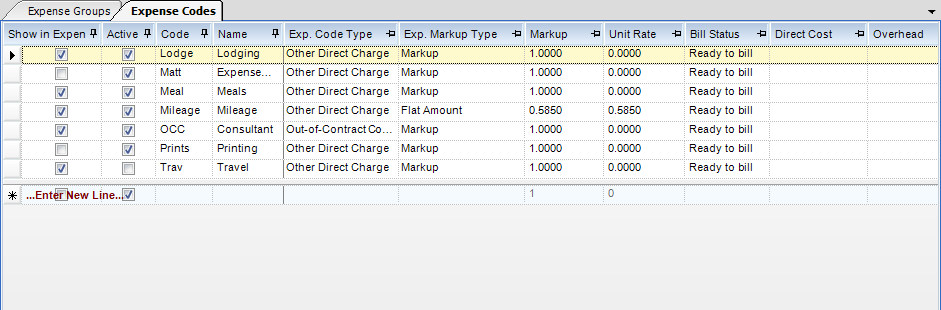

Module: Project Administration Applet: Expense Groups Tab: Expense Codes |

|

Description - Expense Codes need to be created before they can be added to Expense Groups. Adding Expense Codes is as simple as filling out a new row in the grid and clicking Save.

Grid descriptions are listed below

Expense Code Grid

| • | Show in Expense Sheet - When checked, the expense will be visible in an employee expense sheet entry. |

| • | Active - When checked, the expense code is active and can be added to an Expense Group. |

| • | Code - Expense code. The code that will be associated with this Expense. The Code must be unique. |

| • | Name - Expense Name. The Name that will be associated with this Expense. |

| • | Exp. Code Type - Allowable PM types for the expense code are chosen here. They include Other Direct Charges, Out-of-Contract Consultants, In-Contract Consultants, Consultants (either OCC or ICC) and Any. |

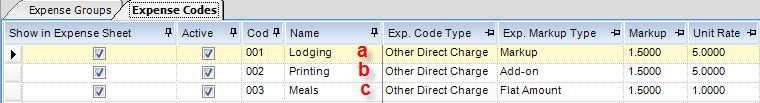

| • | Expense Markup Type - There are three types of Expense Markup Types: (a) Markup, (b) Add-on,and (c) Flat Amount (see Fig.1). Below shows how each Markup type is calculated. |

Markup - Unit Rate X Qty X Markup (Amount entered in Markup Column)

Add-on - [Unit Rate + Markup (Amount entered in Markup Column)] X Qty

Flat Amount - Qty X Markup (Amount entered in Markup Column))

| • | Markup - This changes depending on the Expense Markup Type selected. Note: The amount entered in the Markup Column can be the Markup, Add-on, or the Flat Amount depending on what Markup Type you select. |

Markup - Multiplier used to mark up the Unit Rate.

Add-on - Amount you would like to add on to the unit rate.

Flat Amount - Flat amount that you would like to charge per unit.

EXAMPLE OF MARKUPS IN USE

A. Expense Codes Set

(Fig.1)

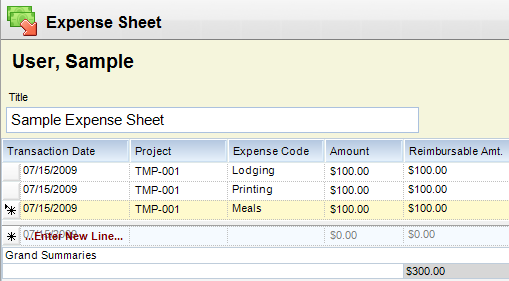

B. Expense Codes Entered in Expense Sheet

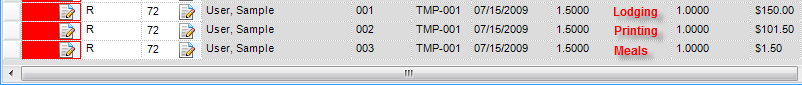

C. Expense Codes as they appear in PA Bill Review

| • | Unit Rate - Unit cost rate. The amount you pay, per unit, for the expense. This can be overridden in the Expense Journal. Typically used for things like Gas, Printing, etc., when you have a set unit rate amount. Note: This will default in all Expense Sheets and Expense Journals. |

| • | Bill Status - Default bill status. |

| • | Direct Cost - This is the G/L base account for direct expense. |

| • | Overhead - This is the G/L base account for indirect expense. |

| • | Direct Bill Revenue - This is the G/L base account for expense billed revenue direct portion. |

| • | Markup Billed Revenue - This is the G/L base account for expense billed revenue markup portion |

| • | Unbilled Revenue - This is the G/L base account for expense unbilled revenue. |

| • | Comment Template - This is where you assign a comment template to the expense code. |

| • | Internal Comment Template - This is where you assign a comment template to the expense code. |

| • | Non-Reimbursable - Where expense codes can be flagged as non-reimbursable for expense sheets. |