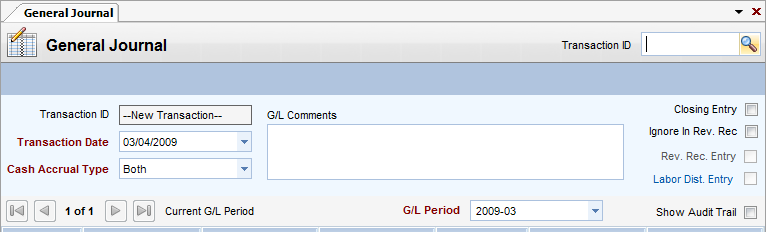

Module: General Accounting Applet: General Journal |

|

Description: The Header Section of the General Journal

Fields

| • | Transaction ID - Transaction ID is system generated and read only. It uniquely identifies a transaction. |

| • | Transaction Date - The Transaction Date is relevant only for Project Management reports, Otherwise, it is informational. |

| • | Cash Accrual Type - The three choices are Cash, Accrual, or Both. |

| • | G/L Comments - Comments to appear in G/L report. The comments will show on the control side and, if no G/L comment is entered on the line item, will also print on those as well. |

| • | Closing Entry - When checked, this entry is considered a Closing Entry. Closing Entries can be excluded on financial statements, if desired (usually done on P & L). |

| • | Ignore In Rev. Rec. - Ignore in Revenue Recognition. When this entry is flagged, revenue recognition does not include this transaction in calculations. |

| • | Rev. Rec. Entry - When checked, this entry was posted by Revenue Recognition. Revenue Recognition can delete any entries for the current period when run. This flag identifies the entry as a candidate for deletion. This is a read-only field. |

| • | Labor Dist. Entry - When checked, this entry was posted by Labor Distribution. Deleting or voiding this transaction will cause all time sheets that were associated with it to an un-posted state. This is a read-only flag. Click on the icon next to the check box to see a breakdown to the employee level of the automated posting. |

| • | G/L Period - General ledger period for this transaction or revision to effect. Defaults to current period and only open periods are allowed. |