Common Accounting Tutorials |

|

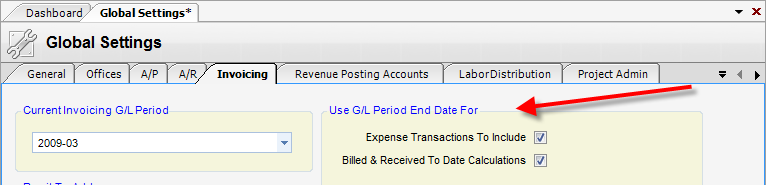

Description: How dates are analyzed in 1. Automated Invoicing and 2. PA Bill Review. Under Use G/L Period End Date For, there are two check boxes, one that determines what transactions show up in invoicing, and another that determines what date to use when calculating Billed and Received To Date figures.

1. AUTOMATED INVOICING - In Automated Invoicing, dates are analyzed differently depending on the Global Settings, Invoicing tab. (Fig. 1)

When the Expense Transactions To Include box:

Is Checked (Fig.1) - The G/L period that the "As-Of" date falls in is used as the cut-off. It then compares that period to the period the transaction was posted in.

Is Not Checked - The "As-Of" date specifically is used as the cut-off.

Purchase Journal = Invoice Date

Disbursement Journal = Check Date

Employee Reimbursable Journal = Transaction Date (per line)

When the Billed and Received To Date Calculations box:

Is Checked (Fig.1) - The G/L period that the "As-Of" date falls in is used as the cut-off. It then compares that period to the period the transaction was posted in.

Is Not Checked - The Invoice Date specified is used as the cut-off. It is then compared to previous invoice dates.

(Fig.1)

2. PA BILL REVIEW - In PA Bill Review, dates are analyzed in a similar way to Automated Invoicing.

When the Expense Transactions To Include box:

Is Checked (Fig. 1): The G/L period that the "As-Of" date falls in is used as the cut-off. It then compares that period to the period the transaction was posted in.

Is Not Checked: The "As-Of" date specifically is used as the cut-off.