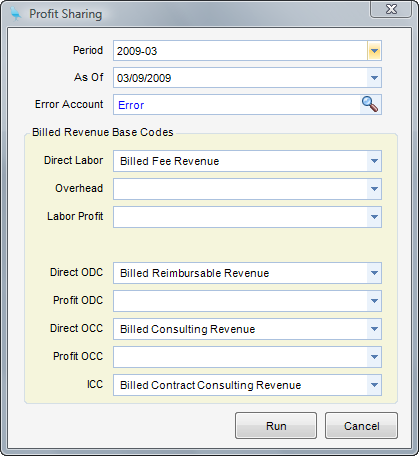

Module: Project Administration Applet: Profit Sharing |

|

Description - This utility is primarily meant for companies with multiple profit centers that would recognize revenue as billed. This utility credits the effort amount (labor at a billing rate and expense at the marked up value) based on the charging profit center. It then debits the owning profit center of the project for the reverse amount. Time and material projects this will yield a profit-sharing based on each center’s effort amount. On fixed fee and not-to-exceed type projects all over-run and under-run will be attributed to the owning profit center. Typically, this utility would be run once a month after billing has been completed.

The second function of revenue recognition is profit sharing within projects. Multiple profit centers can earn revenue on a single project by establishing sharing profit centers on a project. This is done by opening a project and right clicking on the project name. The sharing profit centers live at a specified level of the WBS on any given project. This can be varied on a project-by-project basis. Each node at the sharing level can have profit centers assigned for sharing. One of the sharing centers can be designated as the prime sharer. In addition to sharing profit centers, one profit center can be designated as the project owner. This is set at the Bill Terms Node (Project). There are three types of profit centers: owners, primary sharers, and other sharers.

All profit centers established at each node can have revenue methods set for the four PM types.

In Global Settings, the level in the organization structure (OBS) project at which sharers live. The owners must then reside at the same level or above. For instance consider the following OBS.

Org Level 1 - Office Org Level 2

New York (NY) Architecture (AR)

Engineering (EN)

Los Angeles (LA) Architecture (AR)

Engineering (EN)

In this scenario, if sharers were designated to live at the 2nd level, shares could be one of four org units: NY-AR, NY-EN, LA-AR and LA-EN. Owners could not only be one of those four, but, in addition, the two offices NY and LA.

When revenue is calculated, it is done in three steps. First, the regular sharers are calculated, then the primary shares, and, finally, the owners. This allows primary sharers and owners can bear the brunt of overruns, or, in the case of owners, gain the benefit of under-runs. For instance, sharers can be set to earned revenue at billable values with no cap while the owner is set with a cap. If the overall project cap is exceeded only the owner would get penalized in this manner.

When the sharer's revenue is calculated, only transactions charged to that profit center are considered. Note that the primary will also be calculated.

The primary sharer for a project node is used only when an overall cap for the node has been established. Revenue calculated for the entire node and its children (after sharing has been calculated) is compared with the overall node cap. If the revenue exceeds the overall node cap then the primary will absorb the over-run.

After revenue has been calculated for sharer’s, primary and other, revenue is again recalculated for the entire project using all transactions. Any variance between what has been calculated by the sharers and what is now calculated by the owner is applied to the owner.