Overview

End of Year Closing in InFocus is an automated journal entry. The purpose is to take the year-to-date amounts in all income and expense accounts and reverse them into retained earnings. This effectively zeros out the income and expense accounts for a fiscal year.

The journal entry is made to the General Journal and is flagged as a closing entry. This allows the entry to be ignored for profit and loss type financial statements. The entry is posted in the last period of the fiscal year in question with a transaction date equal to that periods end date.

For cash base conversion, the utility must be run twice - once for cash and once for accrual.

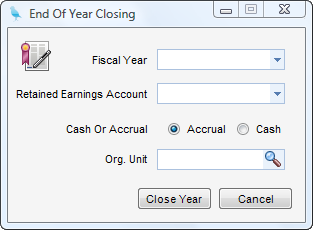

Running the procedure requires the following information:

| • | Fiscal Year - Fiscal year to close |

| • | Retained Earnings Account - Offset account for income and expense. |

| • | Cash Accrual - Option for closing books for cash or accrual. |

This utility can be run as many times as needed for a given year. If all amounts are zero, no entry will be posted.