Overview

Expense Codes/Groups allow for the categorization of expenses for project reporting and invoicing. Examples are Prints, Travel, Meals, etc. They allow for varied markup per category.

| • | There are three types of Expense Markup Type. Markups can be Multiplier, Add-on of flat Amount. |

| • | Can be assigned Direct Cost, Indirect Cost, and Revenue G/L Accounts. |

| • | Can be restricted to PM types (ex., ODC,OCC,ICC) |

| • | Can default in billing status (ex., Ready to Bill, Never Bill, etc.) |

| • | Can be budgeted in Project Planning |

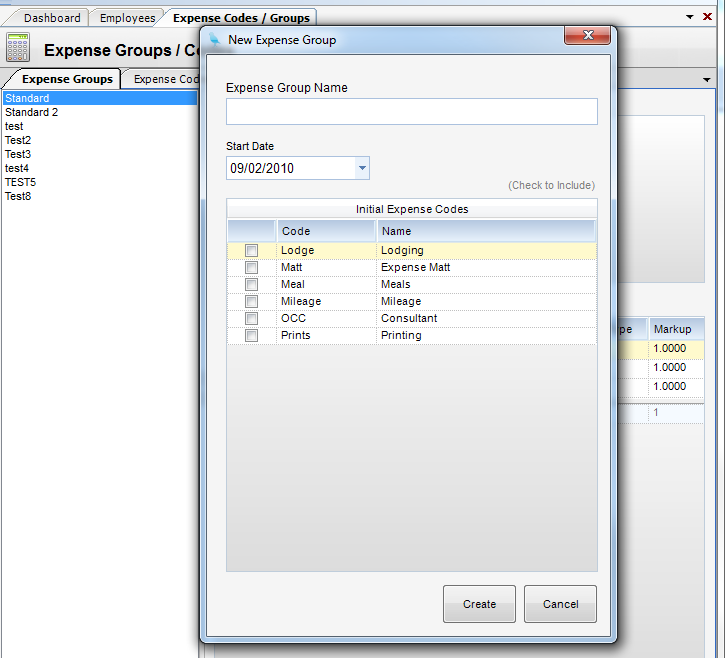

Expense Groups allow for subsets and overrides of expense codes that can be assigned to a project.

Expense Groups allow for non-labor expenses to be grouped into categories. This allows for billing categories to be established without the need for changing the chart of accounts. For example, if a client demands that air travel be separated from local travel, it would not be necessary to set up a separate ODC travel G/L account.

Expense Groups provide a mechanism for varied unit billing and markups.

Note: Once expense codes are established, they are then placed in expense groups. An expense code can belong to many groups. In turn, groups are applied to projects. Groups can also have effect dates, allowing for the revision of markups/rates on perhaps an annual basis. Expense groups are the expense equivalent of labor rate schedules.