Overview

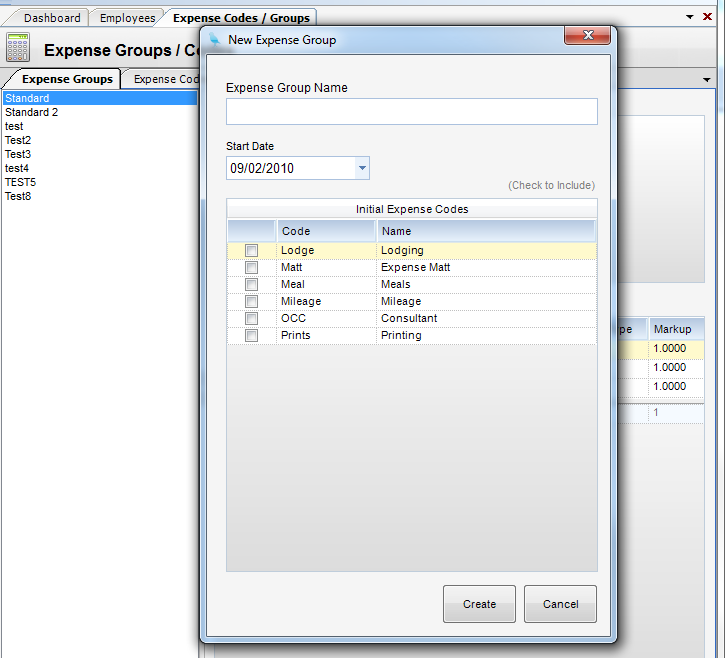

Once Expense Codes are established they are are then placed in Expense Groups. An Expense Code can belong to many groups. In turn groups are applied to projects. Groups also can have effect dates (Expense Periods) allowing for the revision of markups/rates on perhaps an annual basis. Basically, Expense Groups are the expense equivalent of Labor Rate Schedules.

Note: When expense groups are used in expense sheets, their default G/L accounts will come in when those transactions are transferred to the Employee Reimbursable Journal.

Grid descriptions are listed below

Expense Periods

| • | Start Date - This is the start date of the selected Expense Group. |

Period Expense Code Grid

| • | Expense Code - This is the expense code. It must already exist to be applied to a group. Selecting a code will fill out the rest of the grid. You can, however, override these values here. |

| • | Name - Expense Name |

| • | Exp. Code Type - This is the allowable PM types for this Expense Code. |

The choices are Other Direct Charges (ODC), Out-of-Contract Consultants (OCC), In-Contract Consultants (ICC), Consultants (either OCC or ICC), and Any Type.

| • | Expense Markup Type - There are three types of Expense Markup Types: (a) Markup, (b) Add-on,and (c) Flat Amount (see Fig.1). Below shows how each Markup type is calculated. |

Markup - Unit Rate X Qty X Markup (Amount entered in Markup Column)

Add-on - [Unit Rate + Markup (Amount entered in Markup Column)] X Qty

Flat Amount - Qty X Markup (Amount entered in Markup Column))

| • | Markup - This changes depending on the Expense Markup Type selected. Note: The amount entered in the Markup Column can be the Markup, Add-on, or the Flat Amount depending on what Markup Type you select. |

Markup - Multiplier used to mark up the Unit Rate.

Add-on - Amount you would like to add on to the unit rate.

Flat Amount - Flat amount that you would like to charge per unit.

| • | Unit Rate - Unit cost rate. The amount you pay, per unit, for the expense. This can be overridden in the Expense Journal. Typically used for things like Gas, Printing, etc., when you have a set unit rate amount. Note: This will default in all Expense Sheets and Expense Journals. |

| • | Bill Status - Default bill status. |

| • | Direct Cost - This is the G/L base account for direct expense. |

| • | Overhead - This is the G/L base account for indirect expense. |

| • | Direct Bill Revenue - This is the G/L base account for expense billed revenue direct portion. |

| • | Markup Billed Revenue - This is the G/L base account for expense billed revenue markup portion |

| • | Unbilled Revenue - This is the G/L base account for expense unbilled revenue. |