Overview

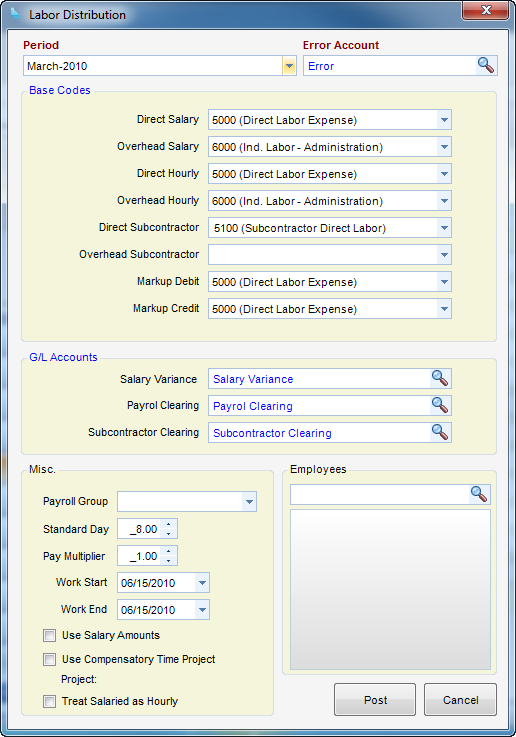

The purpose of labor distribution is to post labor to the General Ledger and mirror payroll. Labor Distribution posts labor figures to the General Ledger based on timesheet entries. The process scans timesheets that have been approved, but not yet processed by this utility. In general, labor is divided between direct and indirect labor cost accounts. Some initial configuration of Labor Distribution is done in Global Settings (Fig.1).

(Fig.1)

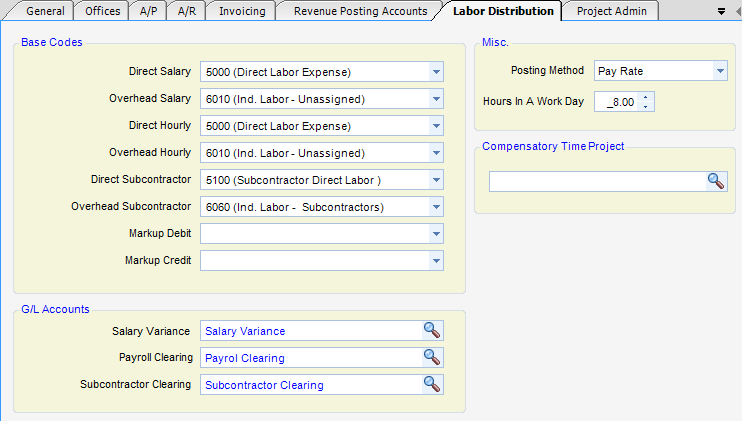

There are four Posting Methods to use to calculate the amount to post (Fig.1 Posting Method dropdown located in the Misc. Box):

1) Pay Rate - Labor is calculated at the pay rate value in timesheets.

2) Job Cost Rate - Labor is calculated at the job cost rate value in timesheets.

3) Bill Rate - Labor is calculated at the bill rate value in timesheets.

4) Pay Rate X Multiplier - Labor is calculated at the pay rate value in timesheets and then multiplied by the supplied multiplier when this utility is run.

When using any method except pay rate, you can split the difference between pay rate and the select method into two debit and credit base accounts. This allows the user to transfer an overhead portion in cross-charge scenarios from one organization to another, and maintain visibility of that overhead transfer in the General Ledger.

When run, this utility makes a single entry for the pay period in the General Journal and marks it as a labor distribution entry. It then flags all timesheet entries that were a part of the run with the General Journal transaction ID. Deleting the General Journal transaction will erase the link to timesheets, allowing them to be reprocessed in a future run.