Overview

There are two ways to view overhead on project management reports.

1) Use the Job Cost Rate to include any overhead burden. This allows the user to view figures down to the transaction level (i.e., employee and work date). If the Job Cost Rate is used for other purposes, or if the Rate Calculations do not field the desired effect, use the Overhead Allocation Journal for this purpose.

2) Overhead Allocation can be made only to the bottom nodes of the WBS and to an accounting period. It cannot be applied to an employee or work date. Using this method allows the user to use the specific overhead variables in Project Management Report Design. These are not used in the default shipped reports.

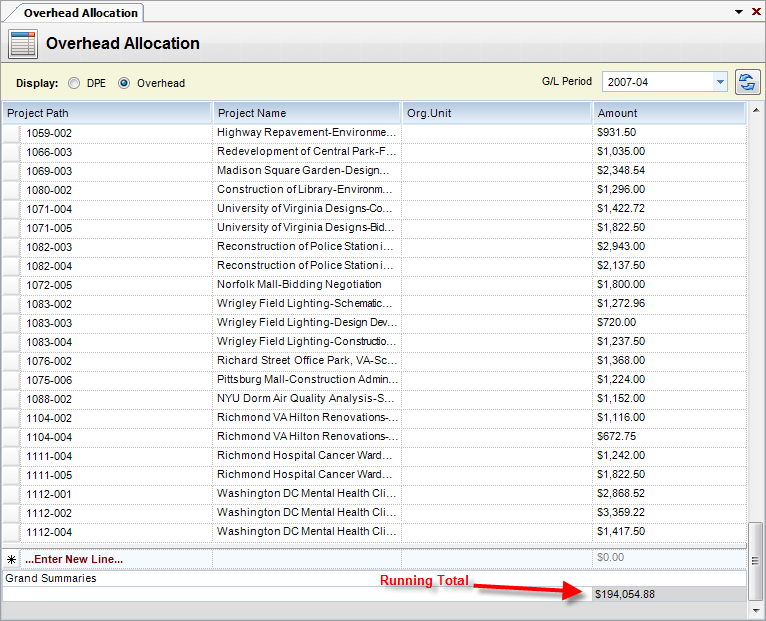

The overhead journal allows for two types of transactions: DPE (direct personal expense) and OH (overhead).

Overhead (or DPE) for a given period is calculated by multiplying the pay rate by an overhead factor and then adding that to all billable projects worked on in the period. This can be done automatically by using the Automate Allocation option in the toolbar. Selecting this option will produce a warning that it will delete all overhead transactions for the given period.

Grid Descriptions Below

The dialogue box will prompt you for the following:

| • | DPE - Select this if the allocation is for DPE. |

| • | Overhead - Select this if the allocation is for overhead. |

| • | G/L Period - General ledger accounting period to use for posting and labor transaction evaluation. |