|

Overview

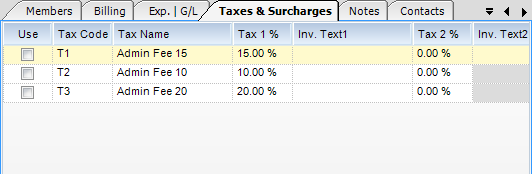

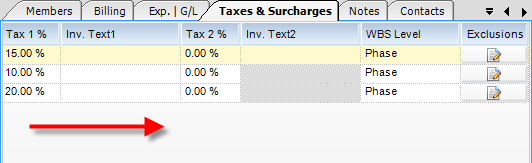

The Taxes and Surcharges tab establishes taxes and/or Surcharges used for the project selected. In order to enforce the tax/surcharge, a Taxes section must be used in the Invoice Design for the invoice being used for the selected project.

Field descriptions are listed below

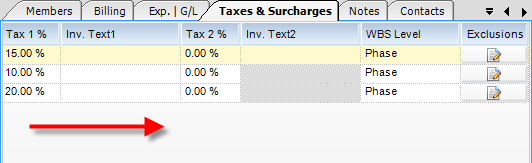

Scroll Across

Fields

| • | Use - When checked, the selected tax will be used in the selected project. |

| • | Tax Code - Tax code assigned to the tax. |

| • | Tax Name - Name of the tax. |

| • | Tax 1 % - Percentage of the Tax/Surcharge. Used in the first tax field in the Invoice Design. |

| • | Inv. Text1 - Text that shows up on the invoice next to the first tax/surcharge. |

| • | Tax2% - Percentage of the Tax/surcharge used in the second tax field in the Invoice Design. |

| • | Inv. Text2 - Text that shows up on the invoice next to the second tax/surcharge. |

| • | WBS level - The WBS level in which the Tax/Surcharge is enforced. |

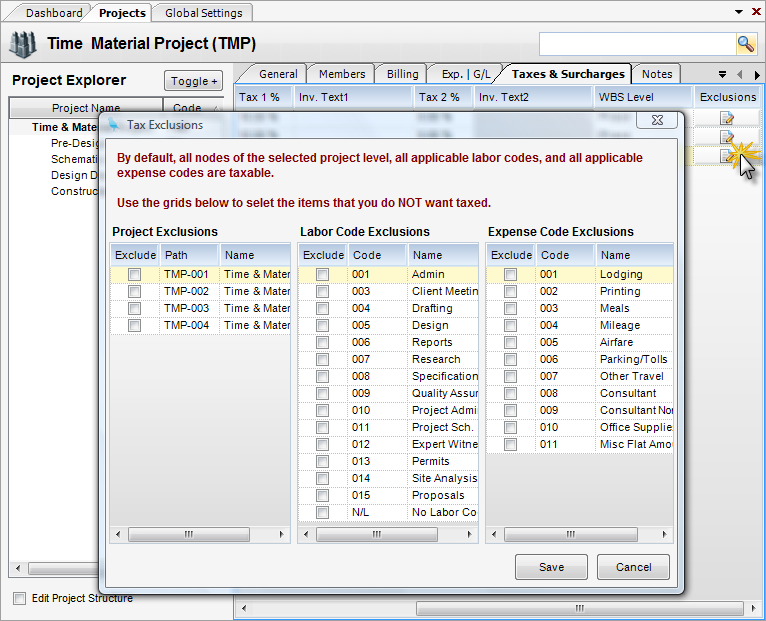

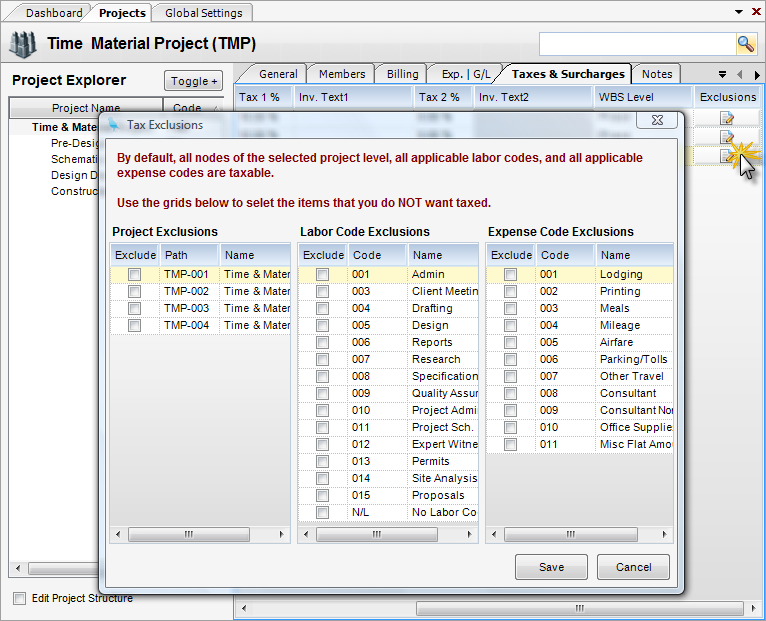

| • | Exclusions - In the Exclusions column, click the icon and a box (pictured below) will pop up. Select the tems that you DO NOT want taxed. |

|