Overview

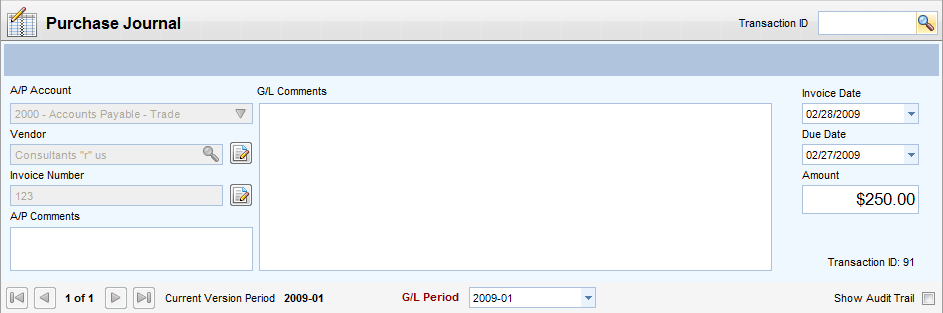

The header section contains the common data for a vendor invoice. It contains the Accounts Payable account and amount. This section is referred to as the control side.

There are three key fields that uniquely identify a vendor invoice.

1) The Accounts Payable account

2) The Vendor

3) The Invoice Number

Note: If you have permissions, you can edit (on an already saved record) the vendor or invoice number. This can be done by selecting the notes icon next to each field. No audit is retained on the change.

Fields

| • | A/P Account - Accounts Payable G/L account. This is the control account. It must have a sub-ledger type of accounts payable. A/P sub-ledger reports can be printed for an individual or combined account (account indifferent). |

| • | Vendor - Vendor for this transaction. Once saved, you need special permission to change. |

| • | Invoice Number - Vendor invoice number. Once saved, you need special permission to change. |

| • | G/L Comments - Comments to appear in G/L report. Will show on control side and, if no G/L comment is entered on the line item, will also print on those as well. |

| • | A/P Comments - Appears on Accounts Payable report. |

| • | Invoice Date - Vendor invoice date. |

| • | Due Date - Automatically calculated by adding net days from the vendor setup to the invoice date. Can be overridden here. |

| • | Amount - Amount of invoice. Must balance to the line entries in the detail section. |

| • | G/L Period - General ledger period for this transaction or revision to affect. Defaults to current period; only open periods allowed. |

| • | Show Audit Trail - When checked, all entries, including reversing entries, will display. It will also include a line for the header section of the transaction. Auto-reversals and header lines will be grayed out and cannot be altered. |