Overview

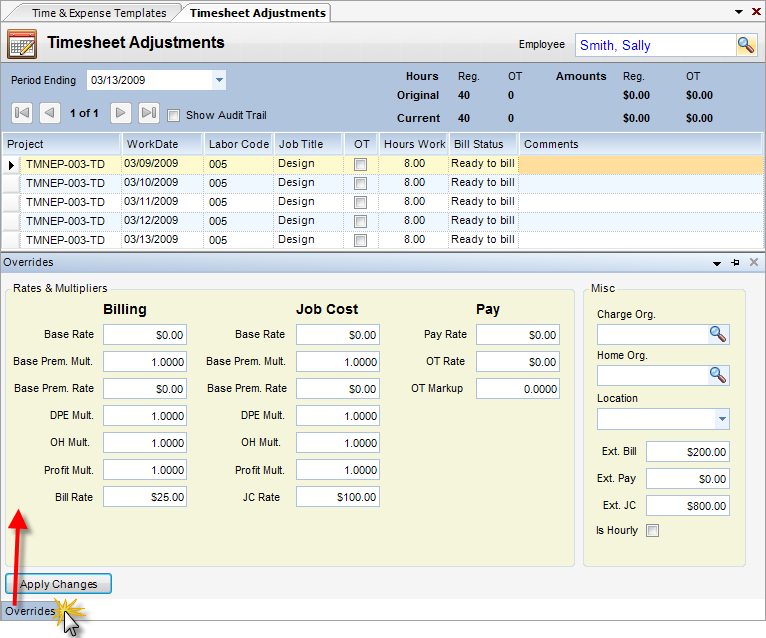

The Timesheet Adjustments Journal is used to make adjustments against an already existing timesheet. New timesheets cannot be entered here. Once a timesheet has been modified, it can no longer be sent back to the manager or owner (timesheet rejection). Timesheet adjustments are most commonly used to move hours between projects. This is usually done by someone in the Accounts Receivable department.

Note: Modifications to the timesheet via timesheet adjustments will not effect the original version of the timesheet.

Giving TA Permissions - While a user can be given rights to make timesheet adjustments, the sum of the adjustments must not alter the original hours and cost worked figures. This can be prevented by not giving the user the standard Edit or Delete rights in Timesheet Adjustments. Instead, grant only Edit Grid permission.

Enabling Full Audit - If Full Audit is enabled in Global Settings, any change to critical data (Project, Home, or Charge Org Unit, Work Hours or the Dollar Amount that is used for Distribution) will result in the system recording an automatic reversing entry and storing your changes as a new item. If not enabled, the prior automatic adjustment will occur only if this line item has already been processed by Labor Distribution.

The normal mode of operation in Timesheet Adjustments is for the user to record only hours when entering time items. The system automatically calculates rates, multipliers, and extended amounts. Any calculated stored information for a line item can be overridden. The system does not, however, make the automatic calculations. The user must change the extended amount if a rate is changed manually.

Field Descriptions Below

Line Items Grid

| • | Period Ending Date - Drop-down box that displays the period ending dates of Employee Timesheets. |

| • | Project - Allowable WBS path for this employee. |

| • | Work Date - Must be within timesheet coverage period. |

| • | Job Title - Allowable job title for this employee on this project. |

| • | OT - When checked, hours are overtime or premium. |

| • | Hours Work - Hours worked. |

| • | Bill Status - Billing status. |

| • | Comments - Comments that can appear on project management reports or invoices. |

Overrides - Accessed for any line item by clicking on the Overrides button in the lower left hand portion of the screen.

| • | Billing Base rate - Base rate used when calculating bill rates. |

| • | Billing Base Prem. Mult. - Multiplier applied against base rate for premium time. If changed, it auto-calculates billing base premium rate. |

| • | Billing Base Prem. Rate - Base premium rate used for calculating premium bill rate. When changed, it auto-calculates premium multiplier. |

| • | Billing DPE Mult. - Direct personal expense multiplier. |

| • | Billing OH Mult. - Overhead multiplier. |

| • | Billing Profit Mult. - Profit Multiplier. |

| • | Bill Rate - Billing Rate |

| • | Job Cost Base rate - Base rate used when calculating job cost rates. |

| • | Job Cost Base Prem. Mult. - Multiplier applied against base rate for premium time. If changed, it auto-calculates billing base premium rate. |

| • | Job Cost Base Prem. Rate - Base premium rate used for calculating premium job cost rate. When changed, it auto-calculates premium multiplier. |

| • | Job Cost DPE Mult. - Direct personal expense multiplier. |

| • | Job Cost OH Mult. - Overhead multiplier. |

| • | Job Cost Profit Mult. - Profit Multiplier. |

| • | Job Cost Rate - Job Cost Rate. |

| • | Pay Rate - Pay rate. |

| • | OT Rate - Overtime rate. |

| • | OT Markup - Overtime multiplier. |

| • | Charge Org. - Org unit that receives the cost of this line item. |

| • | Home Org. - Org. Unit to which employee belonged on this work date. |

| • | Ext. Bill - Extended bill amount (usually bill hours x bill rate). |

| • | Ext. Pay.- Extended pay amount (usually work hours x pay rate). |

| • | Ext JC - Extended job cost amount (usually work hours x job cost rate). |

| • | Is Hourly - When checked, indicates that employee was classified non-exempt on this work date. |