Overview

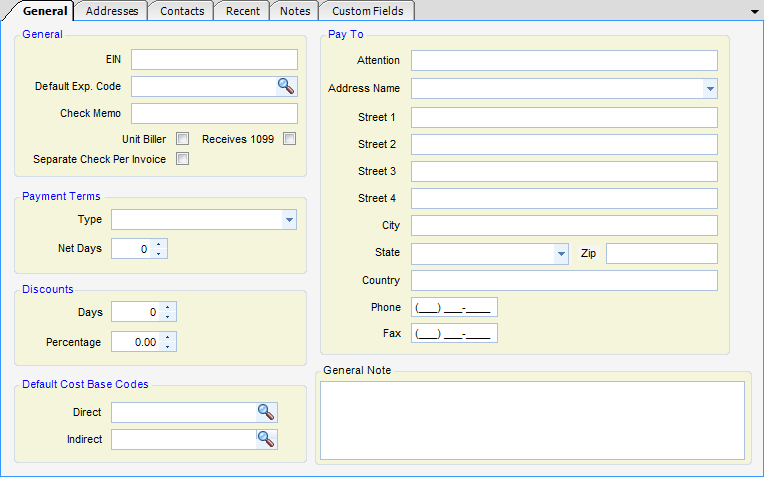

The General Tab (Field Descriptions Below)

General

| • | EIN - Employer Identification Number |

| • | Default Exp Code - Default expense code |

| • | Check Memo - Memo to be written on the checks for this vendor. |

| • | Unit Biller - When checked, a units (quantity) field will automatically show in the Purchase Journal for the selected vendor. |

| • | Receives 1099 - When checked, designates that the vendor normally receives a 1099. |

| • | Separate Checks Per Invoice - When checked, the vendor will receive a separate check per invoice. |

Payment Terms

| • | Type - User-defined payment terms. Informational only. |

| • | Net Days - Net days to add to vendor invoice to calculate due date. |

Discounts

| • | Days - Number of days past invoice date when a discount can be realized. |

| • | Percentage - Percentage to apply against invoice amount to calculate discount. |

Default Base Codes

| • | Direct - Default G/L base account for direct charges |

| • | Indirect - Default G/L base account for indirect charges |

Pay To - Pay to address. This is the address that can be printed on checks. A named firm address can be used here.

| • | Attention |

| • | Address Name |

| • | Street 1 |

| • | Street 2 |

| • | Street 3 |

| • | Street 4 |

| • | City |

| • | State |

| • | Zip |

| • | Country |

| • | Phone |

| • | Fax |

General Note - Where general notes regarding the Vendor can be entered.