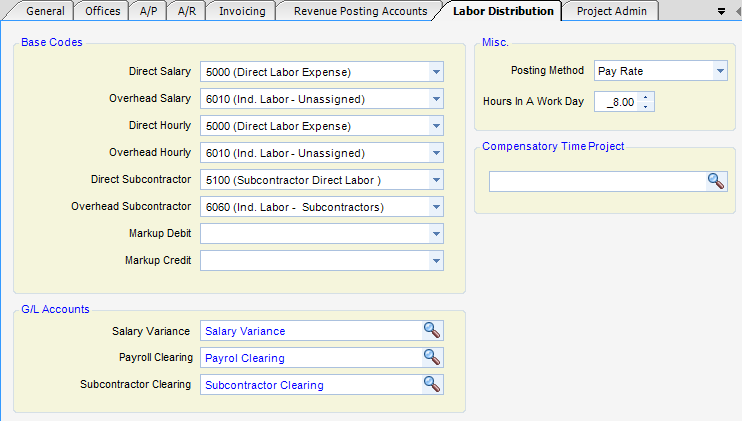

Module: Administration Applet: Global Settings Tab: Labor Distribution |

|

Description: Labor Distribution Tab. Settings on this tab control Labor Distribution postings (field descriptions below).

Base Codes - These are the default base codes. Some, or all of them can be overridden by base codes at the job title, and those can be overwritten by base codes at the project level.

| • | Direct Salary - Direct Labor base account for salaried employees. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is direct; and the project management type is labor. It cannot be flagged as a subcontractor base account. |

| • | Overhead Salary - Indirect Labor base account for salaried employees. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is indirect; and the project management type is labor. It cannot be flagged as a subcontractor base account. |

| • | Direct Hourly - Indirect Labor base account for non-exempt employees. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is indirect; and the project management type is labor. It cannot be flagged as a subcontractor base account. |

| • | Overhead Hourly - Indirect Labor base account for non-exempt employees. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is indirect; and the project management type is labor. It cannot be flagged as a subcontractor base account. |

| • | Direct Subcontractor - Direct Labor base account for subcontractors (timekeepers who are not employees). It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is direct; and the project management type is labor. It must be flagged as a subcontractor base account. |

| • | Overhead Subcontractor - Direct Labor base account for markup portion. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is direct; and the project management type is labor. It is used only when a marked-up value (not pay rate) is used. |

| • | Markup Debit - Direct Labor base account for markup portion. It is combined with the charged organization to derive a valid G/L account. The metric type is cost; the cost type is direct; and the project management type is labor. It is used only when a marked-up value (not pay rate) is used. |

| • | Markup Credit - Direct Labor base account for the offset of the markup portion. It is combined with the employee home organization to derive a valid G/L account. The metric type is cost; the cost type is direct; and the project management type is labor. It cannot be flagged as a subcontractor base account and is used only when a marked-up value (not pay rate) is used. |

G/L Accounts

| • | Salary Variance - G/L account to post the difference between an exempt employees salary and their distributed pay rate amount. |

| • | Payroll Clearing - Offset or suspense G/L account for direct and indirect labor (non- subcontractor). |

| • | Subcontractor Clearing - Offset or suspense G/L account for direct and indirect subcontractor labor. |

Misc.

| • | Posting Method - Rate method used for posting labor. There are four choices: pay rate, job cost rate, bill rate, or pay rate time (a supplied multiplier—supplied at run time). |

| • | Hours In A Work Day - Standard number of hours in a work day. In Labor Distribution, it is used salary variance calculations, if compensatory time is not booked. It is also used in resource management projections. |

Compensatory Time Project

| • | Look-up Box - Project to which compensatory time is posted. When posting compensatory time, salaried variance is washed through a compensatory project. |