Module: Human Resources Applet: Recalculate Labor Rates |

|

Description: How to Recalculate Labor Rates

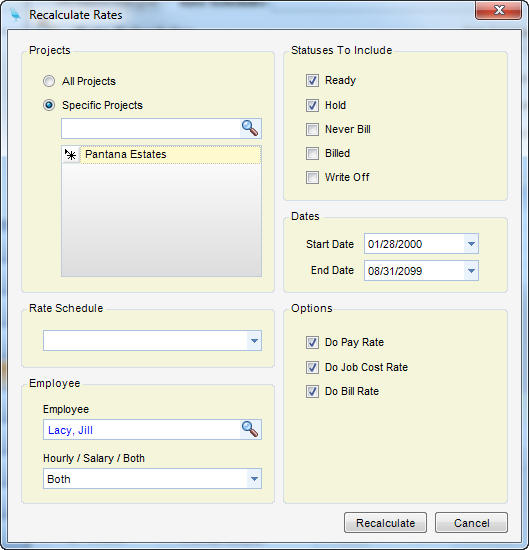

Step 1 - Choose to recalculate rates for All Project or a Specific Project.

Step 2 - Check the boxes with the Statuses to Include (Typically Ready and Hold) for the line items (transactions) to be included in the recalculation.

Step 3 - Then select a Start Date and an End Date for the transactions that you would like to include.

Step 4 - Decide what type of rates to calculate - Pay Rate, Job Cost Rate, or Bill Rate - and check the appropriate boxes.

Step 5 - Decide whether or not to leave an audit trail, then check the appropriate boxes. The importance of an audit trail concerns Labor Distribution. An audit trail should be left if the date range covers transactions that have been processed by Labor Distribution, and if that range change could affect distributions.

Step 6 - Click Recalculate.

Note - If recalculating bill rates while using Pay Rates or Job Cost Rates for Labor Distribution, audits are unnecessary, as they would have no effect on distributions.

An audit posts a reverse entry of the existing timesheet line item at the old rate and then inserts a new one with the new rate.

Only timesheets that result in a new extended rate amount will be audited.