Module: Project Administration Applet: Projects |

|

Description - How to Understand Revenue Recognition and Profit Centers.

Revenue Recognition / Profit Centers

This utility serves two purposes: 1) it posts earned revenue and 2) it performs profit sharing within projects.

Revenue recognition is to used to meet the GAAP principle of recognizing revenue in the same accounting period that the expense was incurred. When this utility is run, labor and expense transactions are calculated based on user-set rules to obtain an earned revenue value on a project-by-project basis. The system then calculates the previous earned revenue. The difference is posted to unbilled revenue and offset to WIP. When automated invoicing is used, whatever gets posted to billed revenue is relieved from WIP and offset against unbilled revenue.

Rules can be established for each PM type (labor, ODC, OCC, and ICC). Rules can analyze expense transactions at cost or marked up (billable value), and analyze labor at any of the three rates (pay, job cost, or bill). Values can then be compared to maximums of upsets to prevent over-valuing. The rules can also earn revenue based on user-entered percent completion.

All billing statuses (except for Never Bill) are included. Never Bill is determined in Global Settings.

When upsets occur, the overage is posted against an upset G/L account. This allows for a separation from the standard unbilled revenue account. You can make this the same as the standard. In other words, you could use one unbilled labor revenue account for both the labor revenue and the upset labor revenue. This technique is also useful regarding expenses. Expense revenue will post by expense code if available. In the case of a cap, you can post the overage to a separate account without randomly penalizing any expense code.

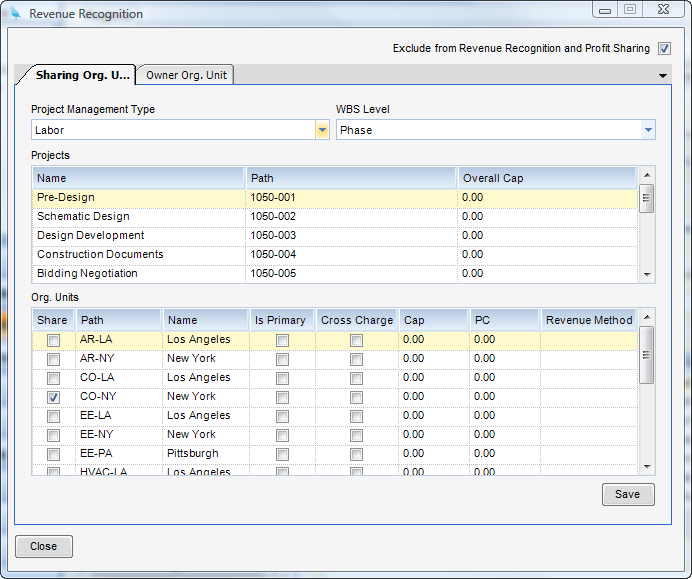

NOTE - Exclude from Revenue Recognition and Profit Sharing (checkbox) - When checked, the project will be ignored in Profit Sharing adjustments (Fig.1).

(Fig.1)

Profit Sharing - To understand Profit Sharing, see the Profit Sharing section in this manual.

Posting - To understand Posting, see the Post Earned Revenue section in this manual.

Labor Methods

| • | Pay rate with no cap - Transactions are analyzed at pay rate. There is no maximum |

| • | Job cost rate with no cap - Transactions are analyzed at job cost rate. There is no maximum |

| • | Bill rate with no cap - Transactions are analyzed at bill rate. There is no maximum |

| • | Pay rate with cap - Transactions are analyzed at pay rate. They are capped if applicable. |

| • | Job cost rate with cap - Transactions are analyzed at job cost rate. They are capped if applicable. |

| • | Bill rate with cap - Transactions are analyzed at bill rate. They are capped if applicable. |

| • | Percent complete - Transactions are analyzed at a user enter precent complete versus cap. |

| • | Cap amount - Revenue is set equal to cap amount. |

Expense Methods

| • | Cost amount with no cap - Transactions are analyzed at cost. There is no maximum |

| • | Bill amount with no cap - Transactions are analyzed at marked up or billable value. There is no maximum |

| • | Cost amount with cap - Transactions are analyzed at cost. They are capped if applicable. |

| • | Bill amount with cap - Transactions are analyzed at marked up or billable value. They are capped if applicable. |

| • | Percent complete - Transactions are analyzed at a user enter precent complete versus cap. |

| • | Cap amount - Revenue is set equal to cap amount. |