Overview

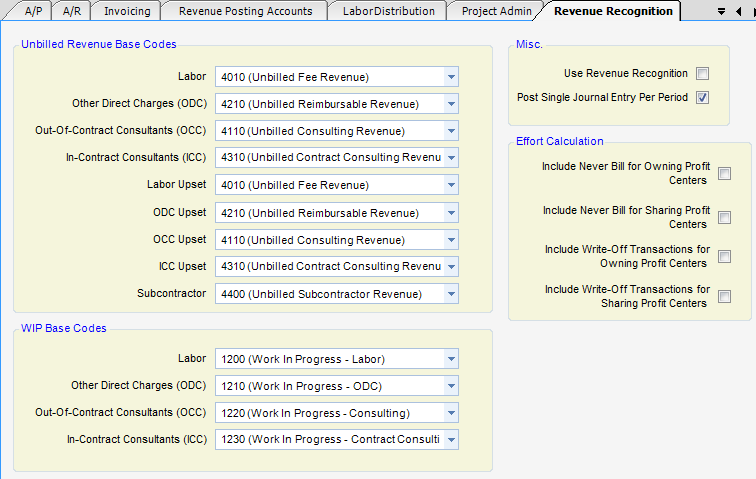

Revenue Recognition Tab. Settings on this tab control automated Revenue Recognition postings (field descriptions below).

Unbilled Revenue Base Code

| • | Labor - Account for Labor Gross Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of Labor. |

| • | Other Direct Charges (ODC) - Account for ODC Gross Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of ODC. |

| • | Out-Of-Contract Consultants (OCC) - Account for OCC Gross Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of OCC. |

| • | In-Contract Consultants (ICC) - Account for ICC Gross Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of ICC. |

| • | Labor Upset - Account for Labor Overrun Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of Labor. When a cap is exceeded, this account will be debited for the amount of the overrun. |

| • | ODC Upset - Account for ODC Overrun Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of ODC. When a cap is exceeded, this account will be debited for the amount of the overrun. |

| • | OCC Upset - Account for OCC Overrun Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of OCC. When a cap is exceeded, this account will be debited for the amount of the overrun. |

| • | ICC Upset - Account for ICC Overrun Earned Revenue. Base account must have a metric type of unbilled revenue and a project management type of ICC. When a cap is exceeded, this account will be debited for the amount of the overrun. |

| • | Subcontractor - Account for Subcontractors. |

WIP Base Codes

| • | Labor - Base account for Labor work-in-progress. |

| • | Other Direct Charges (ODC) - Base account for ODC work-in-progress. |

| • | Out-Of-Contract Consultants (OCC) - Base account for OCC work-in-progress. |

| • | In-Contract Consultants (ICC) - Base account for ICC work-in-progress. |

Misc

| • | Use Revenue Recognition - Indicates whether Revenue Recognition screens will be available in the system. |

| • | Post single journal entry per period - Flag indicating if only one entry should be used per period for Revenue Recognition postings. When checked, any previous entry in the same accounting period as the current processing period will first be deleted. |

Effort Calculation

| • | Include Never-Bill Transactions for Owning Profit Centers - Flag indicating if transactions with a never-bill status should be included in the calculation of effort in Revenue Recognition formulas for owning profit centers. |

| • | Include Never-Bill Transactions for Sharing Profit Centers - Flag indicating whether transactions with a never-bill status should be included in the calculation of effort in Revenue Recognitions formulas for owning profit centers. |

| • | Include Write-Off Transactions for Owning Profit Centers - Flag indicating if transactions with a write-off status should be included in the calculation of effort in Revenue Recognition formulas for owning profit centers. |

| • | Include Write-Off Transactions for Sharing Profit Centers - Flag indicating if transactions with a write-off status should be included in the calculation of effort in Revenue Recognition formulas for sharing profit centers. |