Terms

The following terms are used throughout the manual and are foundational to understanding InFocus Multi-Currency.

InFocus Mulit-Currency (IMC) – Refers to the multi-currency feature available in InFocus. This feature allows a system to operate across multiple currencies. Throughout the manual this is referred to as IMC.

Currency Code – International three character monetary code. For example, USD for U.S. Dollars.

Base Currency – All systems will have one base currency which is considered the base system operating currency. Systems not operating in IMC will default to a base currency of USD (U.S. Dollars). Exchange rates for cost and effort is based on system tables and is the rate of exchange from the transactional currency (defined below). The base currency is the currency used for purposes of consolidation. Accounting transaction debits and credits must equal for this currency. Exchange rates for cost and effort is based on system tables and is the rate of exchange from the transactional currency (defined below).

Company Currency – This is utilized when multiple companies or legal entities reside within a single database and those companies operate under differing currencies. This is designated at the first level of organizational units and defines the operating currency of that org. Accounting transaction debits and credits must equal for this currency. Exchange rates for cost and effort is based on system tables and is the rate of exchange from the transactional currency (defined below).

Transactional Currency – This is the real world currency of a given transaction. It is from this currency that monies are translated based on system configured rates of exchange. Transactional currency is derived from the sub-ledger account used on the transaction. For instance, if entering a Purchase Journal, using an AP account assigned a currency of USD, the transactional currency (or currency environment) for the transaction would be USD. As such, transactional currency is set at the sub-ledger account level. Accounting transaction debits and credits must equal for this currency. The existing monetary fields (prior to version 2.0) represent the transactional currency.

Project Currency – The currency used in project administration and project planning and is defined on the project. Project management reports can also optionally print using this currency. Accounting transaction debits and credits do not need to equal for this currency. Exchange rates for cost and effort can be overridden at the project level. Please note that project budget amounts are always entered in the Project Currency.

Invoicing Currency – The real world (or transactional) currency for the sales journal and is defined on the project. While multiple currencies can be represented on a single invoice, the Invoicing Currency is the real world currency for a given client invoice transaction. Time and expense journals will hold an invoicing currency at the transactional level. This value can be either the transactional currency (defined by the time sheet employee or sub-ledger respectively) or the project invoice currency. An exchange rate of exactly 1.0 dictates that the invoice currency designation on the transaction is set to the project invoicing currency.

Evaluation Date – The date used in the evaluation of exchange rates for a given transaction. This is represented in each InFocus journal by a date field titled "MC Effective Date".

Precision – Defines columns to the right of the decimal place for a given currency.

Units – This is the smallest unit in a given hard currency. For example, one (for one cent) would be the setting for USD. Units are assigned singular and plural labels for major and minor units. For example, "dollar" and "dollars" (or "cent" and "cents") would be the singular and plural labels respectively for the major and minor units in USD.

Triangulation – For purposes of currency conversion, triangulation is the means by which a currency can be converted to another currency in the absence of globally defined exchange rate. A triangulating currency acts as an interim currency between the two, otherwise relationally undefined, currencies.

Reciprocal – This method, often referred to as the inverse method, is used to define the inverse rate of exchange between two currencies.

Key Concepts

Supported Currencies

InFocus aligns with Microsoft's supported currencies. A full list can be found here.

Currency Pairs

Currency Pairs establishes the exchange relationship between two given currencies. This relationship is defined by an exchange rate as of a given start date and is configured in General Accounting>Multi-Currency. Additionally, the currency pair can act as an inverse partner (optional). For example, if a USD to Euro pair was setup with an inverse relationship, a pair defining Euro to USD would not be needed (and in fact would be not allowed). Inverse pairs use the reciprocal of the stated multiplier when converting in the reverse direction. A pair can also cite a triangulation currency. A triangulation is used when no direct exchange rate between currencies exist. For instance, if an exchange rate from Yen to Euro did not exist but exchanges between Yen and USD and USD to Euro did exist then a Yen to Euro pair could be entered that triangulated via USD.

Exchange Rates

Exchange rates are the vehicle by which monies in one currency are converted to another. InFocus supports Currency based and project-specific Project and/or Invoice exchange rate configuration where the Currency rate acts as a general system rate and the Project and/or Invoice rate acts as a project-specific rate override. Currency exchange rates, configured in General Accounting>Multi-Currency, can be set manually or imported from a system defined third party source. Both triangulation and inverse methods are supported. Project and/or Invoice exchange rates, configured in Project Administration>Projects, only affect the designated project and invoicing currencies. Configured exchange rates can be refreshed as needed.

Exchange Dates and Multipliers

Defined currency pairs include an effective start date for each exchange rate. This start date is utilized by the system to establish the proper exchange multiplier (rate) based on the evaluation date recorded on the transaction. InFocus compares the evaluation date to the currency pair that represents the transactional currency of a given transaction and returns the multiplier of the most recently precedent start date. In the event no exchange rate is found the system uses a multiplier of one (1.0) and colors the transaction

currency-related columns red.

Evaluation Date Methods

In IMC, each journal includes a date field titled "MC Effective Date" which represents the evaluation date used to derive the transaction exchange rate, as described above. InFocus supports four methods for determining the default evaluation date:

| 1. | Current Accounting Period start date |

| 2. | Current Accounting Period end date |

| 3. | Transaction Date |

| 4. | Today's date (system date) |

The default method is set per journal in Administration>Global Settings.

Multi-Company

In a Multi-Company environment, all companies within a single database must consolidate to one currency- the Base Currency (defined above). Though each company may operate from a different company currency, only one currency can be defined when running a consolidated financial statement encompassing both companies. Accounting debits must equal credits for each company currency represented.

MC Revaluations

A new journal has been added to host multi-currency revaluations. Transactions in this journal are marked as realized or unrealized gains and losses. Any revaluation transaction has only two G/L accounts: the sub-ledger account that is being revalued; and the offsetting gains and losses account. Transactional lines include the gain or loss, and can optionally identify the project. A positive value represents a gain while a negative value a loss. This journal does not utilize a debits verses credits approach as a recorded positive value will act as a debit against the sub-ledger (Balance Sheet) account while simultaneously acting as a credit to the gains and losses (P&L) account. While this journal is used by automated system utilities with pre-posting reports to generate realized and unrealized gains and losses, manual entry in this journal is also supported.

Reporting and Automation

Accounting Reports

The following reports have been upsized to support printing in Base, Company and Transactional currencies.

| • | General Ledger (optionally include realized and/or gains and losses) |

| • | Trial Balance |

| • | Financial Statements |

| • | Journal Reports |

Project Management Reports

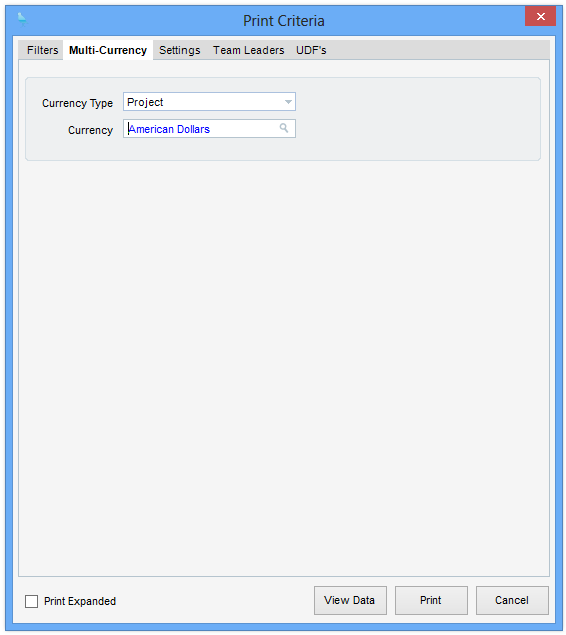

Reports designed in the PM Report Designer support Base, Project, and Invoicing currencies. The user can now filter PM reports by designated currency. For example, a report could be filtered to show results only for projects where the Project currency is set to U.S. Dollars (see below). Please note, the underlying report compiler has been modified to support multi-currency. This new compiler can be utilized by checking "Use 2.0+ Data Format" in Utilities>PM Report Designer under Show Advanced Options.

Custom Reports

The following report has been added to the InFocus system Custom Reports list to support FASB reporting requirements for consolidated balance sheets converting multiple currencies.

| • | MC Consolidated Balance Sheet (FASB) |

Automated Accounting Processes

The following processes have been updated to support InFocus Multi-Currency.

| • | Labor Distribution |

| • | A/P Check Writing |

| • | A/R Check Writing |

| • | Import of Expense Sheets |

| • | Convert To Cash |

| • | Automated Invoicing |