Overview

When the utility is run, an entry is made to the General Journal posting revenue against unbilled revenue and WIP accounts. It is recorded to the appropriate WBS level and expense code, if any. These entries are marked as coming from revenue recognition.

Note: This utility can be run at any interval (daily, monthly, hourly). There is an option in Global Settings to delete all revenue recognition entries in the current period prior to posting. This is useful if a user wants to post revenue on a daily basis but does not want a cluttered ledger.

A user can exclude projects from participating in revenue recognition by flagging them in the project setup profit center section.

A user can also make revenue adjustments in the General Journal and flag them to be excluded from revenue calculations.

Descriptions are listed below

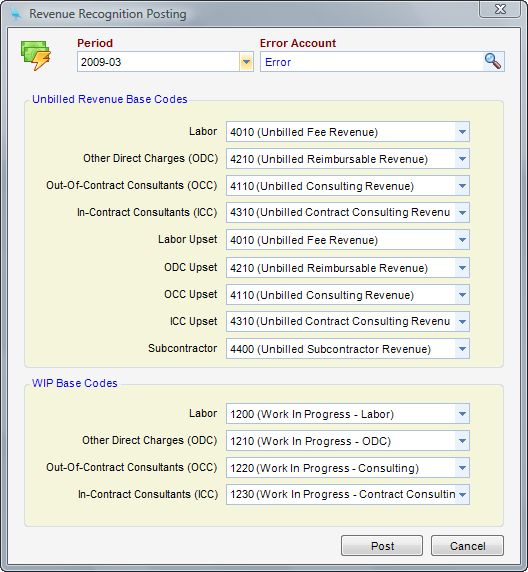

The post utility settings are as follows:

| • | Period - General ledger period. Used as cutoff for transactions and for posting. |

| • | Error Account - General ledger account to use if an account cannot be derived. |

Unbilled Revenue Base Codes

| • | Labor - Unbilled labor revenue base account (non subcontractor) |

| • | ODC - Unbilled ODC revenue base account |

| • | OCC - Unbilled OCC revenue base account |

| • | ICC - Unbilled ICC revenue |

| • | Labor Upset - Unbilled labor revenue upset base account |

| • | ODC Upset - Unbilled ODC revenue upset base account |

| • | OCC Upset - Unbilled OCC revenue upset base account |

| • | ICC Upset - Unbilled ICC revenue upset base account |

| • | Subcontractor - Unbilled labor revenue base account (subcontractor) |

WIP Base Codes

| • | Labor - Work-in-progress labor base account |

| • | ODC - Work-in-progress ODC base account |

| • | OCC - Work-in-progress OCC base account |

| • | ICC - Work-in-progress ICC base account |