Module: General Accounting Applet: Chart of Accounts Tab: Properties |

|

Description: The Properties Tab. InFocus categorizes project management amounts through the Chart of Accounts. It accomplishes this by using two major properties assigned at the account level. These two properties are Metrics and Project Management Types (PM Types). To understand more about the Metrics and PM Types listed below, please refer to the Metrics and PM Types section of this manual.

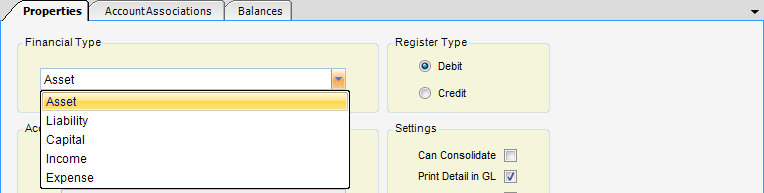

FINANCIAL TYPE(Fig.1)

| • | Choices of financial types include Asset, Liability Capital, Income, and Expense. |

| • | Income and Expense accounts will be zeroed-out to Retained Earnings when the EOY (end of year) posting is run. |

(Fig.1)

ACCOUNT TYPE

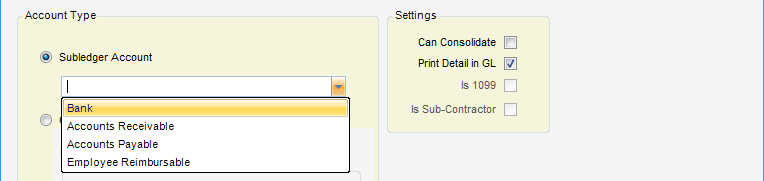

Sub-ledger Account (Fig.2)

Choices of Sub-Ledger types include Bank, Accounts Receivable, Accounts Payable, and Employee Reimbursable.

(Fig.2)

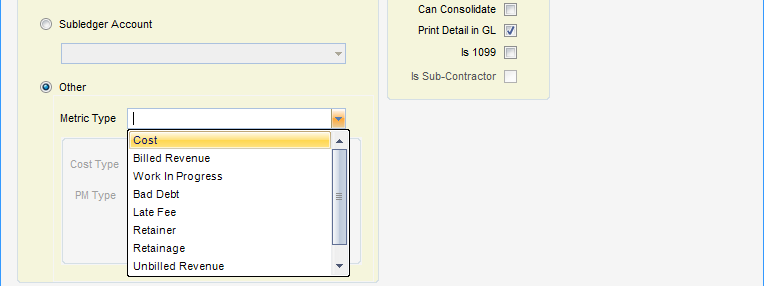

Other - When selected, the account is not a sub-ledger account (Fig.3).

Metric Type - Determines what metric type the account represents for project related transactions. Choices are Cost, Billed Revenue, Work in Progress, Bad Debt, Late Fee, Retainer, Retainage, Unbilled Revenue, and Other Revenue.

(Fig.3)

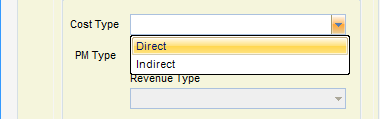

Cost Type - Cost type is available only when the metric type is cost. Choices include Direct and Indirect. (Fig.4).

(Fig.4)

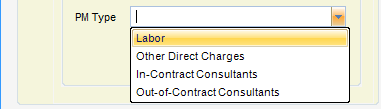

PM Type - Project Management Type is available when the metric type is one of the following: Cost, Billed, Unbilled, or WIP. Those four metric types are then subdivided into Labor, ODC, OCC, and ICC. (Fig.5).

(Fig.5)

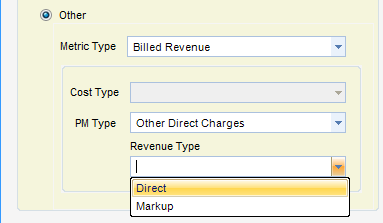

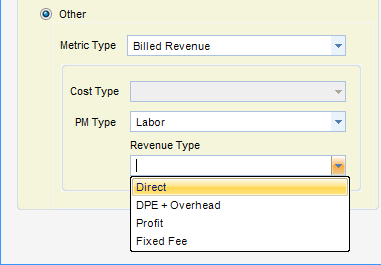

Revenue Type - Only available when the metric type is Billed Revenue. The Revenue Type splits revenue between its cost component and the marked-up component. Revenue Type is needed to calculate Billed-to-Date at some value, other than the marked-up amount, and compare to a capped figure in a Not-to-Exceed type invoice. Otherwise, select the first option "Direct". In the case of Non-Labor Revenue, there are two choices: Direct and Markup (Fig.6). In the case of Labor Revenue, there are four choices: Direct, DPE, DPE + Overhead, and Profit (Fig.7).

(Fig.6)

(Fig.7)

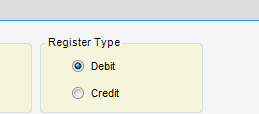

REGISTER TYPE (Fig.8)

The choices are Debit and Credit and the default setting is based on the financial type selected. The Register Type represents the normal balance state of the account. The default is changed only in a few cases, such as a contra account. This Register Type affects only the sign in Financial Statements. InFocus stores debits as positive (+) values and credits as negative (-) values. Setting the Register Type to credit informs Financial Statements to reverse the sign.

(Fig.8)

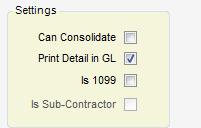

SETTINGS (Fig.9)

Can Consolidate - When checked, the All Org Units for this base account will be merged if Consolidate is chosen when printing a G/L Report.

Print Detail In G/L - When checked, this account will print transaction detail when printing a detailed G/L report.

Is 1099 - Flag indicating whether charges to this account are considered for Form 1099-Misc. This is an optional feature as Form 1099 can be run to consider all payments to a vendor despite this flag.

Is Subcontractor - Indicates that this is a subcontractor cost account. Available only when the metric type is Cost and the PM type is Labor. It is used for labor distributions. Subcontractors different from other consultants because they enter timesheets like an employee.

(Fig.9)