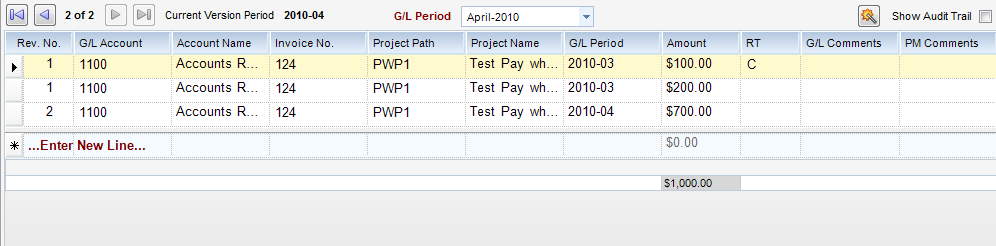

Module: Accounts Receivable Applet: Receipt Journal |

|

Description - Distribution of client invoices to G/L accounts and WBS paths occur here.

Note: If you are on a new row, F2 duplicates the row from above, otherwise it copies the row you are on to a new line.

Fields

| • | Rev. No. - The number of the revision of the journal entry. The original entry is 1. |

| • | G/L Account - The G/L account allowed is determined by the payee type. For instance, when Client is the payee type then an A/R account is allowed. |

| • | G/L Account Name - Displays the GL Account Name in the detail section. This is optionally shown through the toolbar under View / Columns. |

| • | Invoice No. - Only used when G/L account is either Accounts Payable or Accounts Receivable. |

| • | Project Path - WBS Path. Only available when payee type is Client and G/L account is Accounts Receivable. Note: You can now enter cash receipts to any level of the WBS |

| • | Project Name - Displays the Project Name in the detail section. This is optionally shown through the toolbar under View / Columns. |

| • | G/L Period - Displays the GL Period in the detail section. This is optionally shown through the toolbar under View / Columns. |

| • | Amount - Line item amount. |

| • | RT - Revenue Type - This allows you to earmark how much of a receipt should be considered a certain revenue type. This affects revenue allocation in the new Pay When Paid reports. |

| • | G/L Comments - General Ledger comments. This line item will print on G/L reports in place of comments on transaction header. |

| • | PM Comments - Project Management Comments. Appears on project management reports and invoices. Available only when payee type is Client and G/L account is Accounts Receivable. |