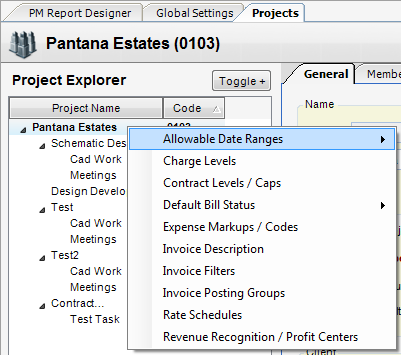

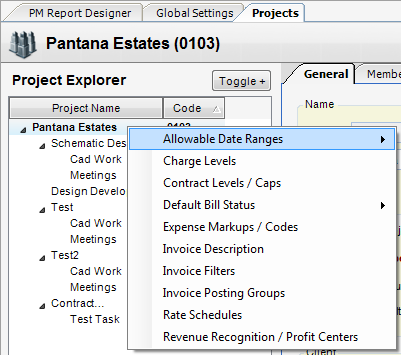

Module: Project Administration

Applet: Projects

Action: Right Click on Project (Bill-Terms Node)

|

|

Description - When you right click on the project (not in Edit Project Structure Mode), you have the following options:

| 1) | Allowable Date Ranges - Allowable Date Ranges can be set for Timesheet and Expense Entry. Date ranges are allowed to have no Start Date or End Date to leave them open-ended. Date ranges can also be controlled from project planning. For instructions on how to use them, see the How to set Allowable Date Ranges section of this manual. |

| 2) | Charge Levels - Charge levels control to what level ODC, OCC, and ICC can be applied. No level needs to be established for time charges since they always occur at the bottom node. For instructions on how to use them, see the How to Establish Charge Levels section of this manual. |

| 3) | Contract Levels / Caps - This is where you establish contract levels and caps. For instructions on how to use them, see the How to set Contract Levels / Caps section of this manual. |

| 4) | Expense Markups / Codes - This is where you establish Expense Multipliers and Expense overrides on a per-project basis. For instructions on how to use them, see the How to set Expense Markups/Codes section of this manual. |

| 5) | Invoice Description - Invoice comments are available at every level of the WBS. |

| 6) | Invoice Filters - This feature allows for using mixed style billings on a single project without the need to create a roll-up project or an invoice group. A filter is a user-definable code that can be placed on the second level nodes (usually called phases) within a project WBS. For instructions on how to use them, see the How to Use Invoice Filters section of this manual. |

| 7) | Invoice Posting Groups - This gives you an option to assign Invoice Posting Groups. |

| 8) | Rate Schedules - Rate schedules can be applied to any or all nodes of the WBS. Children nodes override parents nodes. For instructions on how to use them, see the Applying Rate Schedules section of this manual. |

| 9) | Revenue Recognition / Profit Centers - Revenue Recognition is used to meet the GAAP principles of recognizing revenue in the same accounting period in which the expense was incurred. For instructions on how to use them, see the Revenue Recognition / Profit Centers section of this manual. |

|