Description: How to Handle In-House Expenses.

In each of the cases discussed in the Determining How To Handle In-House Expenses section of the manual, you are basically entering a zero dollar transaction.

For example, if you entered internal prints in the purchase journal you would create a zero dollar transaction against and in-house vendor. You would then enter line items against various transactions. There are two methods:

| • | Zero cost against projects and general ledger |

| • | Cost against general ledger and projects |

Method #1 |

|

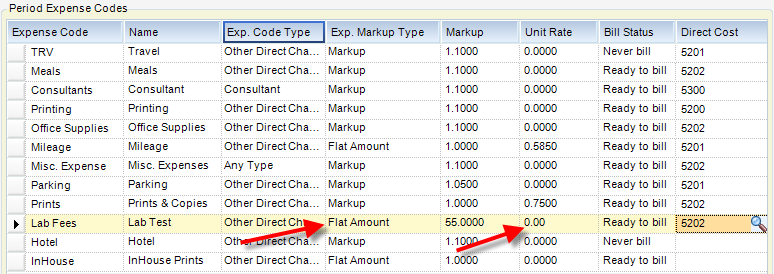

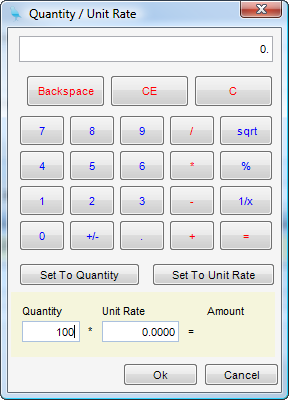

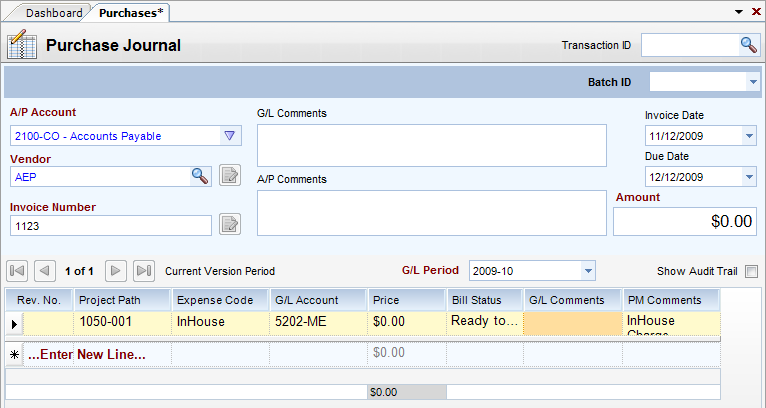

In this method you would establish expense codes with a flat billing amount with a zero cost rate (Fig.1). You would then simply enter the quantity of prints (Fig.3). The extended amount would be zero (Fig.3).

(Fig.1)

(Fig.2)

(Fig.3)

Method #2 |

|

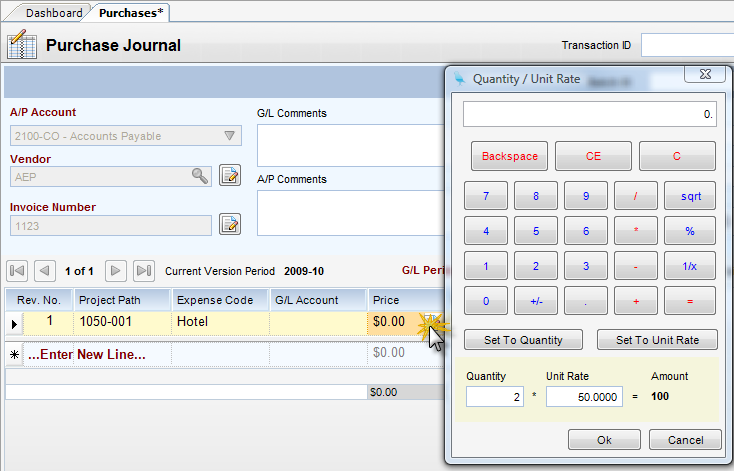

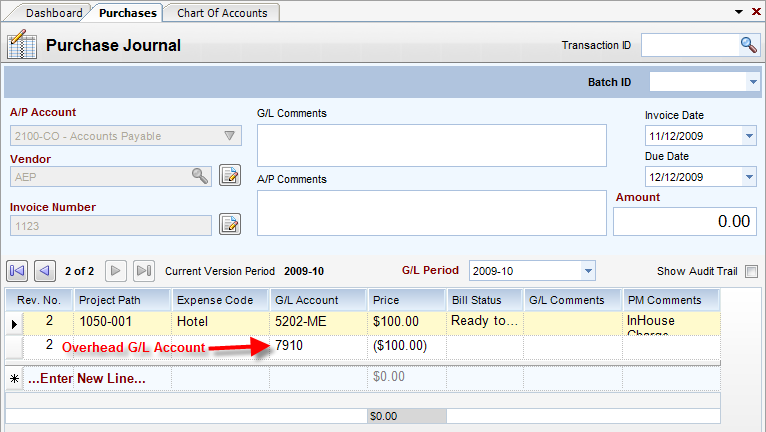

In this method you would enter a quantity and some estimated unit rate. The extended cost amount would be the quantity times the unit rate (Fig.4).

After charging all the required projects you would then enter a negative amount for the running total against an overhead G/L account (Fig.5).

(Fig.4)

(Fig.5)