Overview

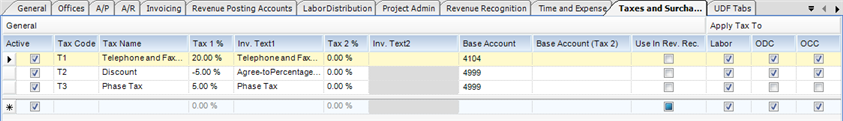

Taxes and Surcharges Tab. Settings on this tab relate to the Taxes and Surcharges Tab (field descriptions below).

"General" Column

| • | Active - When checked, the tax will appear on the "Taxes and Surcharges" tab in the Projects applet. |

| • | Tax Code - Tax code used to differentiate between tax codes. |

| • | Tax Name - Tax Name |

| • | Tax 1 % - Percentage of 1st tax in the Tax Invoice Section. |

| • | Invoice Text1 - Name of 1st Tax as it appears on the invoice. |

| • | Tax 2 % - Percentage of 1st tax in the Tax Invoice Section (optional). |

| • | Invoice Text2 - Name of 1st Tax as it appears on the invoice (optional). |

| • | Base Account - Base account for this tax. |

| • | Base Account (Tax 2) - You can post tax amount 2 to a separate G/L account. |

| • | Use in Rev. Rec. - When checked, the tax will be used in the Rev. Rec. feature in InFocus. |

"Apply Tax To" Column

| • | Labor - When checked, the tax will be applied to the Labor section of the invoice. |

| • | ODC - When checked, the tax will be applied to the ODC section of the invoice. |

| • | OCC - When checked, the tax will be applied to the OCC section of the invoice. |