Overview

Understanding and Managing Profit Centers. Profit Center Sharing is accomplished by assigning organizational units to share in a project’s revenue and expense. The level of the organization that can be assigned as Sharing Profit Centers is established in Global Settings. When organizational units are assigned to a WBS, all employees of that organization (or their children org units) can charge time to that portion of the WBS. Profit Center Sharing Levels are established for the four PM types (Labor, ODC, OCC, and ICC). These levels not only dictate the part of the WBS to which org members can charge, but also represent where organizations can establish intra-profit center caps and rules for revenue recognition.

More specific cross-sharing can be established in Profit Center reporting where the department to receive cross-charges can be varied between nodes at the sharing level. Revenue recognition rules and upset amounts can be established for the owning Profit Center and Sharing Profit Centers. The level where these rules and caps exist must be established for both the owner and the Sharing Profit Centers. It is then calculated for the Owning Profit Center that receives any under-runs or absorbs any over-runs. The owner level cannot exist below the sharing level.

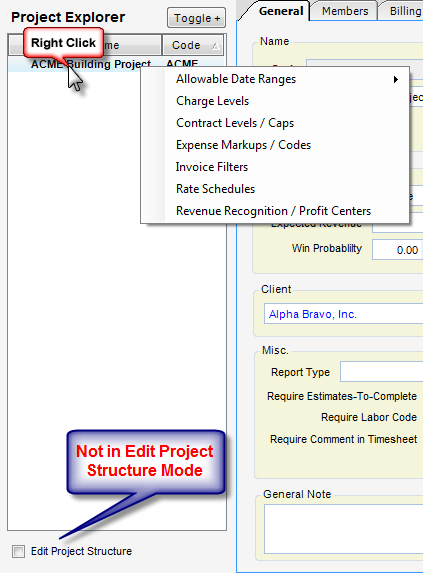

1 - To manage Project Profit Centers, right click on the Bill Terms Node (Project).

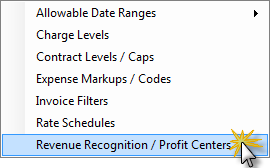

Step 2 - Choose Revenue Recognition/Profit Centers.

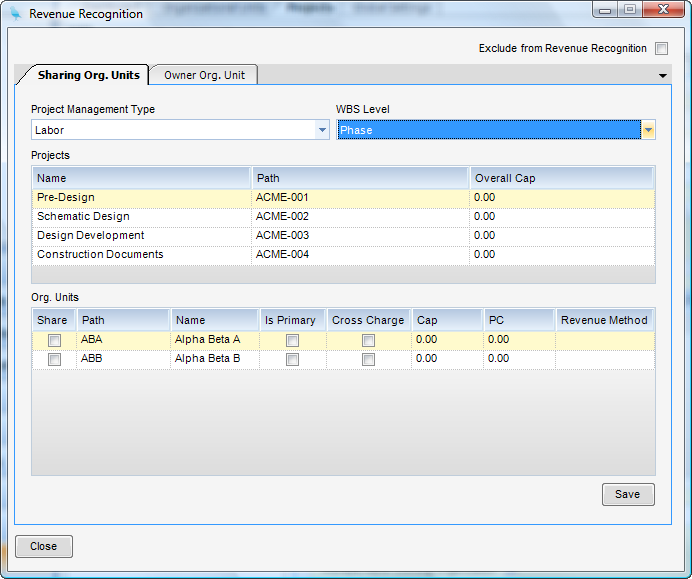

Step 3 - As in contract levels, first select a PM type and a WBS level. Two grids will appear - a Project Grid and an Org Units Grid.

The Org Units Grid shows all org units from the sharing level in the system. There are six fields you can fill out.

Sharing Org. Units Tab

Projects Grid

The Project Grid shows all nodes at the WBS level selected for profit centers. Overall caps can be entered here. When the overall cap is non-zero, over-runs/under-runs are absorbed by the primary Sharing Profit Center.

Org Unit Grid

| • | Share - When checked, this organization can share in the project. |

| • | Primary - When checked, this is the primary org unit for this WBS node. Only one org unit can be the primary. The primary absorbs any overruns/under-runs for the level when a cap is present in the projects grid. |

| • | Cross Charge - When checked, this org unit receives cross-charging for any org units not listed as a share. Only one org unit can be specified for cross-charging. Setting a cross-charge org unit opens up this WBS node and its children to all org units. |

| • | Cap - Cap (if any) to be used in revenue calculations for this org unit. |

| • | PC - Percent complete (if any) to be used for revenue calculations for an org unit. |

| • | Revenue Method - Revenue recognition methods. There are various calculations based on time and material, caps, and percentage completions using various valuation rates. |

Exclude From Revenue Recognition - When checked, the entire WBS (Bill Terms Node (Project) and below) is excluded from revenue recognition processing.

Step 4 - Click Save.